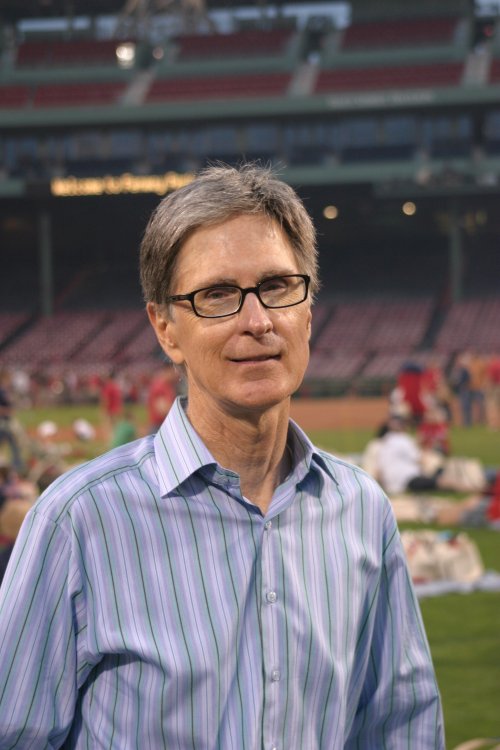

John W Henry, the principal owner of New England Sports Ventures (NESV) and the Boston Red Sox baseball team continues to wait to become the proud owner of Liverpool Football Club.

The highly regarded American businessman made a somewhat surprising appearance this evening as he arrived at 1 Bunhill Row, London, just before 8pm, the offices of Slaughter & May, who have been advising and handling the legal process for Liverpool’s board members Martin Broughton, Christian Purslow and Ian Ayre.

Earlier in the day, following their victory at the High Court over Tom Hicks and George Gillett, Martin Broughton advised that a board meeting would take place this evening at 8pm to progress the sale of the club. The arrival of John Henry immediately suggested that process was even closer to conclusion than first expected.

However as has been the case at many steps of both the Hicks & Gillett reign at the club as well as with the sale process itself, controversy lay just after 10pm, it was confirmed that the present American owners had filed a temporary restraining order (document here) with Judge Jim Jordan of the 160th District Court of Texas, to prevent the sale of the club at present. In addition to what they call an “epic swindle”, a term they should be familiar with from their own financial transactions, they also claim that they will sue Liverpool’s independent board of directors, RBS Plc who control the club’s debt and it’s prospective buyer in the form of John Henry’s New England Sports Ventures (NESV) for a total of $1.6bn (£1bn) in damages.

The pair continue to cite that NESV’s offer to buy Liverpool is “hundreds of millions of dollars below true market value” and other alternative and suitable offers were “swept aside” and ignored by Martin Broughton.

The statement issued by the pair is as follows:

The owners of Liverpool Football Club today reported that a Texas State District Court has granted a temporary restraining order (TRO) enjoining the Board of Liverpool Football Club (LFC) from executing a sale of the Club to New England Sports Ventures (NESV). The court set a hearing date of October 25, 2010.The TRO request, signed by Judge Jim Jordan of the 160th District Court in Dallas, was part of a lawsuit filed today by the owners of LFC against Royal Bank of Scotland (RBS), Martin Broughton, Christian Purslow, Ian Ayre, NESV and Philip Nash. The lawsuit also seeks temporary and permanent injunctions, and damages totaling approximately $1.6 billion (over £1 billion).

The suit lays out the defendants’ “epic swindle” in which they conspired to devise and execute a scheme to sell LFC to NESV at a price they know to be hundreds of millions of dollars below true market value (and well below Forbes magazine’s recent independent $822 million valuation of the club) – and below multiple expressions of interest and offers to buy either the club in its entirety or make minority investments (including Meriton and Mill Financial). It describes how the defendants excluded the owners from meetings, discussions and communications regarding the potential sale to NESV and interfered with efforts by the owners to obtain financing for Liverpool FC.

The Club’s owners are represented by attorneys from the international law firm of Fish & Richardson.

The following are some of the key points in the complaint, which details the roles of RBS and the other defendants, and also describes previously undisclosed offers to purchase LFC:

“The Director Defendants were acting merely as pawns of RBS, wholly abdicating the fiduciary responsibilities that they owed in the sale.”

“RBS has been complicit in this scheme with the Director Defendants. For example, in letters from RBS to potential investors obtained just within the past few days, RBS has informed investors that it will approve of a deal only if there is “no economic return to equity” for Messrs. Hicks and Gillett. In furtherance of this grand conspiracy, on information and belief, RBS has improperly used its influence as the club’s creditor and as a worldwide banking leader to prevent any transaction that would permit Messrs. Hicks and Gillett to recover any of their initial investment in the club, much less share in the substantial appreciation in the value of Liverpool FC that their investments have created.”

“On or about October 4, 2010, Mr. Hicks received a letter of interest from a third potential purchaser represented by FBR Capital Markets (“FBR”), offering to purchase Liverpool FC for £375 to £400 million ($595 to $635 million). The letter informed Mr. Hicks that the potential purchaser would not need financing, possessed the funds to close the transaction, and intended to build a new stadium for Liverpool FC.”

“Additionally, the Plaintiffs learned just days ago about another potential investor that made a similar offer in the £350 to £400 million range that was communicated to Defendant Broughton and another unnamed co-conspirator in late August. According to this investor, Mr. Broughton never responded to the offer. Moreover, when the purported sale to NESV was announced, this investor again contacted Mr. Broughton and informed him that the offer, which significantly exceeded the NESV offer, was still on the table. Again, Mr. Broughton brushed this offer aside without further discussion.”

As the news broke that the TRO had been granted to the dismay of Liverpool fan’s who had started, with caution, to look to brighter days, questions reigned in as to the jurisdiction that a Texas Court could have in such a matter that had already been ruled on by the High Court in the UK. Whilst both NESV and RBS are believed to be respecting the TRO in order to protect their investments in the US and taking legal council on the situation, contact was made by Liverpool fans with the issuing Texan court which resulted in Judge Jim Jordan’s Facebook Page being removed and the courts telephone service becoming “unavailable”.

Liverpool FC responded with a statement of their own in regards to the developments:

“Following the successful conclusion of High Court proceedings today, the Boards of Directors of Kop Football and Kop Holdings met tonight and resolved to complete the sale of Liverpool FC to New England Sports Ventures.

Regretably, Thomas Hicks and George Gillett have tonight obtained a Temporary Restraining Order from a Texas District Court against the independent directors, Royal Bank of Scotland PLC and NESV to prevent the transaction being completed.

The independent directors consider the restraining order to be unwarranted and damaging and will move as swiftly as possible to seek to have it removed.

A further statement will be made in due course.”

The latest developments place RBS in a tight spot with both US interests to protect as well as the Hicks & Gillett debt to call in on Friday of this week, closure tonight would have provided them with 48hrs to conclude arrangements and avoid further conversations around entering the club into administration. The Liverpool FC board remain hopeful that via legal process they can have the TRO removed shortly, ahead of the October 25th Texas court date but in the meantime Hicks and Gillett potentially wriggle free for a couple of days more yet.

info@judgejimjordan.com lets start a campaing against this!!!!!!!! liars out!!!! YNWA FROM BRAZIL

I’m currently a law student at the University of Colorado in Boulder. I’m only a first year so I can’t be completely sure about how this should turn out but I do know a few things based on my study so far.

It is almost without a doubt that the Texas court should be able to have jurisdiction over NESV based on what they call a “Minimum Contacts” test, which is basically a litmus test to see whether or not a given entity has established contacts with a forum state which would allow that state to have jurisdiction over the defendant. In this case, it is probably true that NESV would have taken advantage of the rights and privileges of Texas laws and infrastructure based on its other sports teams and general sports involvement. The question becomes a little more convoluted when you look at Broughton and the rest of the Board. It is probably not the case that they have jurisdiction over them specifically but most likely a good lawyer could show that they represent Liverpool Football Club and RBS’s interests. However, a creditor has sufficient interest in collecting debts owed to them so I think the real rub here is deciding the issue on the “fair market value” of Liverpool FC, which seems to me to be the Messrs. main complaint. This might even involve an official appraisal of the club’s networth which could take a little while to sort out.

Also, I’m not really clear on the effect of the High Court’s decision on the injunction and pending Texas-lawsuit. Their ruling clearly favors Broughton and NESV but it might not matter inside a US court.

I’ll post more information as I run across it. I plan on talking with some of my peers and professors in class tomorrow and will hopefully be able to provide more insight at a later time.

Long story short, this could drag on for a long, long while. In the meantime, we just have to wait and see. These things can get very complicated.

YNWA

I’ve never wished harm on anyone but I honestly hope the stress of losing 144m will cause fat head hicks to have a fatal heart attack, such is my hatred towards him!